Have

you ever thought about retirement? How much money would you require to retire

and lead the same lifestyle?

What is your F.I.R.E number?

If you don’t know what F.I.R.E means, then you definitely need to get yourself

updated.

FINANCIALLY INDEPENDENT, RETIRE EARLY.

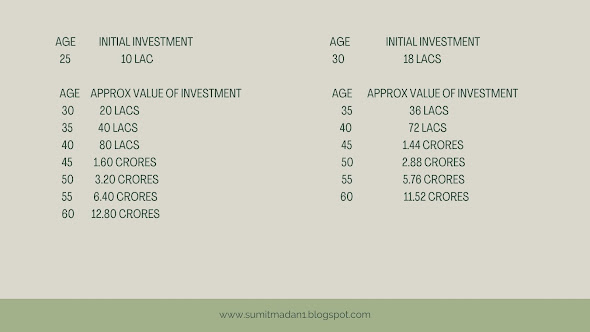

This is a movement where you live below your means in your 20’s and 30’s and

you have more money to invest for your retirement and other goals.

FIRE number is simply the total number of assets you need to create to generate

passive income. It may be stock dividends, bond interests, real estate rentals

or any other form of income without you doing a 9 to 5 job!

As the Guru of Investing, Mr. Warren Buffett once said, “If you don’t learn how

to make money while you sleep, you will work till the day you die”. We can’t

retire unless we have enough passive income to cover the ever growing expenses.

Unfortunately, in India, we do not have any social security or government

pension plans. The ones that exist cater to a very small audience.

So, how should I calculate my FIRE number?

Simply take your total expenses (annually) and multiply it by 25.

WAIT…

before you run to your calculator to run this number there are some things to

take into account. I can bet most of you do not know your annual

expenses. Some of you wise folks out there have done these calculations, but do

we take into account the REAL and HIDDEN expenses?

We usually forget to take into account expenses such as electricity bills,

annual vacation, small vacations, taxation, insurance, buying the latest

gadget, EMIs, Sneakers( YES, you sneakerhead), penny expenses etc.

We need to take into account from buying cough syrup to an expensive car or

vacation. If you get your annual expense number wrong, then your FIRE

number will be small (too easy to achieve) and your retirement may not be as

comfortable as you think.

Some of you may be wondering, Why 25?

This is a reverse calculation knowing the withdrawal rate, which is expected to

be 4%. The Trinity Study is the source of the 4% withdrawal rate. This rule

states that if you only withdraw 4% of your initial portfolio every year, you

can sustain your lifestyle for a very long period. And your withdrawal is

adjusted for inflation every year.

Why is this important?

I come across many people who have abnormally high expenses vis-à-vis their

income and most of us do not realize that we are getting poorer and poorer by

the day; funnily even the kids of rich folks don’t realize this.

If we continue to remain over invested in low yielding assets such as fixed

deposits, gold, real estate and remain under invested in high yielding assets

such as equities, we will never be able to retire. Forget retiring soon!

This is an opportunity we have at hand and we must be wise with our decisions.

In my previous blogs, I have mentioned why I favor equity investments over

other available investments.

Points to remember:-

1. I am not asking you to start living below your means and start compromising

with your life, I just mean being wise and accountable. Remember this quote by Warren Buffett before every purchase, “If you buy things you don’t need soon you will have to

spend things you need”

2. Track & document your expenses. The best way to track is to spend only

one account. Do this exercise for a minimum of one year.

3. I am not against your investment in real estate, gold or fixed deposits-

they are just low yielding asset classes for the ordinary man.

Happy Investing!