Hey there! This blog aims to be the ULTIMATE self-improvement blog. We begin this blog by covering topics of my interest. They are mainly focused on Men's Fashion, Trading and Investing, Personal Finance, Food and Travel.

SIMPLEST & REALISTIC WAY TO MAKE Rs.10 CRORE BY INVESTING.

POWER OF COMPOUNDING

You will come across the definition of Compounding on many platforms and many

people will know the meaning of it, but only a select few actually practice it

in real life.Those select few are usually wealthy people and frugal people.

Many people ask me ‘when is the right time to invest?’ I always say invest today.

The reason to my answer is that timing the market to gain returns on your capital is impossible and time spent in the market is more important than timing the market. If you think you can get rich by investing a few thousand in a ‘TIP’, then god help you. If you think you can get rich fast, then you are wrong.

Having realistic expectations is important. In India, people want to become rich quickly. Let me tell you- Investing in the stock market may be the slowest way of creating wealth, but certainly is the BEST way of growing your wealth.

Founder of Zerodha, Mr. Nithin Kamath recently said that ’99% of the traders don’t make even a bank fixed deposit return in three years in the stock market’. If you apply a little common sense, then you have to only follow the 1% who is not losing their money.

Investing in Fixed deposits, Gold or real estate isn’t going to make you rich or wealthy. These instruments will only increase in value based on the inflation and sometimes demand and supply.

The stock market is known as the capital market, where you get your capital and you’ll get suitable returns over the long term. I am sharing my insight, but you need to have courage to buy, patience to hold. All you have to do is, invest in a low cost index fund (nifty 50) and hold it for the long term.

An index fund (NIFTY 50) is like a mutual fund which invests in the top 50 companies of India. The fund exploits the idea of compounding by reinvesting the profits earned in the underlying stocks and holding the stocks for a long duration. Like any other mutual fund, the fund enjoys the status of a trust, which makes it tax efficient and investors pay tax only upon selling their investments. Over the long term, the deferment of the tax also helps you compound your money at a faster pace.

Over the past 20 years,the Nifty index fund has given average returns of 14-15% CAGR.

The rule of 72- The Rule of 72 is a calculation that estimates the number of years it takes to double your money at a specified rate of return.

For a nifty index fund, number of years to double your money =72/15= 4.8 years

This means that at an average of 5 years, nifty will double and so will your

investment.

You can use this formula and calculate the number of years to achieve your goal.

Now, after knowing this, let's apply to make Rs.10 CRORE.

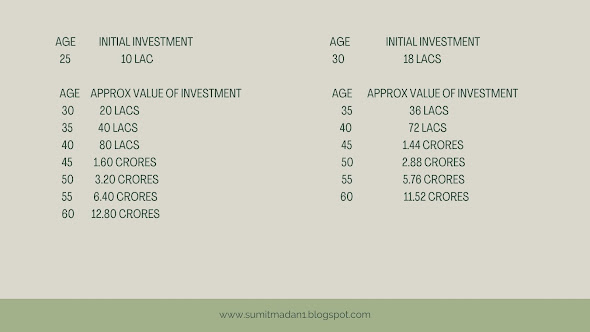

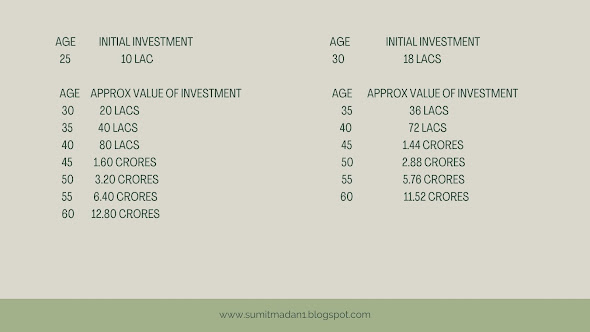

Let us say you are 25 years of age. You need to invest Rs.10 lacs in a low-cost index fund and allow the magic of compounding to work.

For age 30, you need to invest a higher amount of Rs.18 lacs in the same fund to get similar returns.

This shows the earlier you start, the easier it is to achieve your goal and with less capital.

Many people ask me ‘when is the right time to invest?’ I always say invest today.

The reason to my answer is that timing the market to gain returns on your capital is impossible and time spent in the market is more important than timing the market. If you think you can get rich by investing a few thousand in a ‘TIP’, then god help you. If you think you can get rich fast, then you are wrong.

Having realistic expectations is important. In India, people want to become rich quickly. Let me tell you- Investing in the stock market may be the slowest way of creating wealth, but certainly is the BEST way of growing your wealth.

Founder of Zerodha, Mr. Nithin Kamath recently said that ’99% of the traders don’t make even a bank fixed deposit return in three years in the stock market’. If you apply a little common sense, then you have to only follow the 1% who is not losing their money.

Investing in Fixed deposits, Gold or real estate isn’t going to make you rich or wealthy. These instruments will only increase in value based on the inflation and sometimes demand and supply.

The stock market is known as the capital market, where you get your capital and you’ll get suitable returns over the long term. I am sharing my insight, but you need to have courage to buy, patience to hold. All you have to do is, invest in a low cost index fund (nifty 50) and hold it for the long term.

An index fund (NIFTY 50) is like a mutual fund which invests in the top 50 companies of India. The fund exploits the idea of compounding by reinvesting the profits earned in the underlying stocks and holding the stocks for a long duration. Like any other mutual fund, the fund enjoys the status of a trust, which makes it tax efficient and investors pay tax only upon selling their investments. Over the long term, the deferment of the tax also helps you compound your money at a faster pace.

Over the past 20 years,the Nifty index fund has given average returns of 14-15% CAGR.

The rule of 72- The Rule of 72 is a calculation that estimates the number of years it takes to double your money at a specified rate of return.

For a nifty index fund, number of years to double your money =72/15= 4.8 years

This means that at an average of 5 years, nifty will double and so will your

investment.

You can use this formula and calculate the number of years to achieve your goal.

Now, after knowing this, let's apply to make Rs.10 CRORE.

Let us say you are 25 years of age. You need to invest Rs.10 lacs in a low-cost index fund and allow the magic of compounding to work.

For age 30, you need to invest a higher amount of Rs.18 lacs in the same fund to get similar returns.

This shows the earlier you start, the easier it is to achieve your goal and with less capital.

There are two things to remember:

1. Markets don’t go up in a straight line- they are volatile and returns may not be linear, but you have to be patient. You have to be focused on the time spent in the market and ignore the noise.

Subscribe to:

Posts (Atom)

What is your F.I.R.E number?

Have you ever thought about retirement? How much money would you require to retire and lead the same lifestyle? What is your F.I.R.E n...

-

POWER OF COMPOUNDING You will come across the definition of Compounding on many platforms and many people will know the meaning of ...